July 2025 US CPI Analysis: Inflation Trends, Market Reaction, and Fed Outlook

ACY Securities - Luca Santos

ACY Securities - Luca SantosThe July U.S. Consumer Price Index (CPI) release came in with a nuanced message for markets and policymakers.

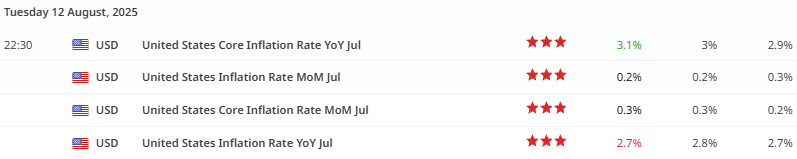

Headline inflation rose 0.2% month-over-month, leaving the annual rate unchanged at 2.7%, slightly softer than the 2.8% most analysts had anticipated.

Core CPI, which strips out volatile food and energy prices, rose 0.3% on the month, pushing the annual rate to 3.1%.

This was the largest monthly core increase since January, and it underscores that while overall price growth is steady, underlying pressures remain.

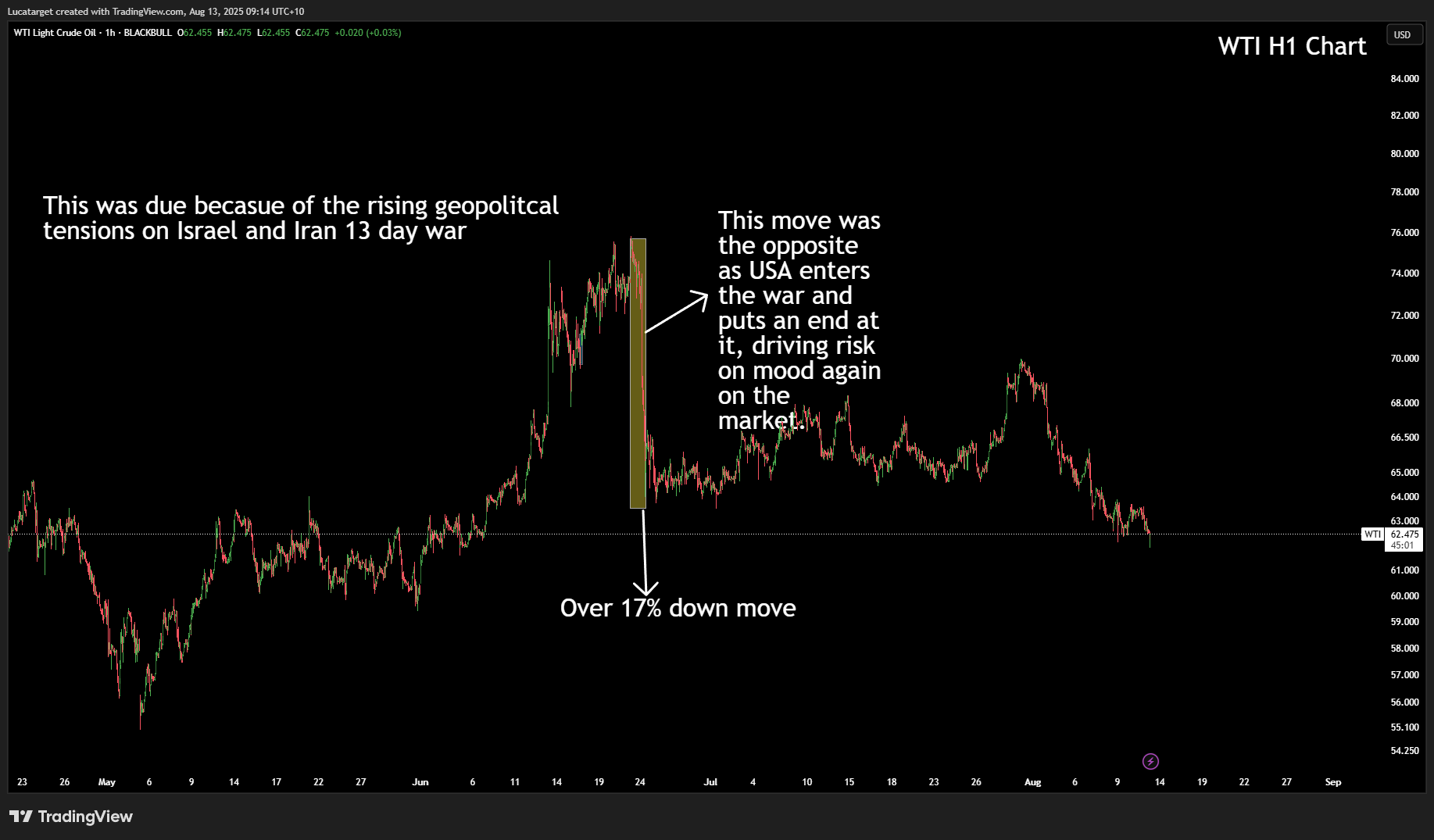

In the days leading up to the release, expectations from analysts around the world leaned towards a modest cooling in inflation, particularly given recent softness in energy prices including WTI and more stable food costs.

The headline number delivered that moderation, but the core reading told a different story.

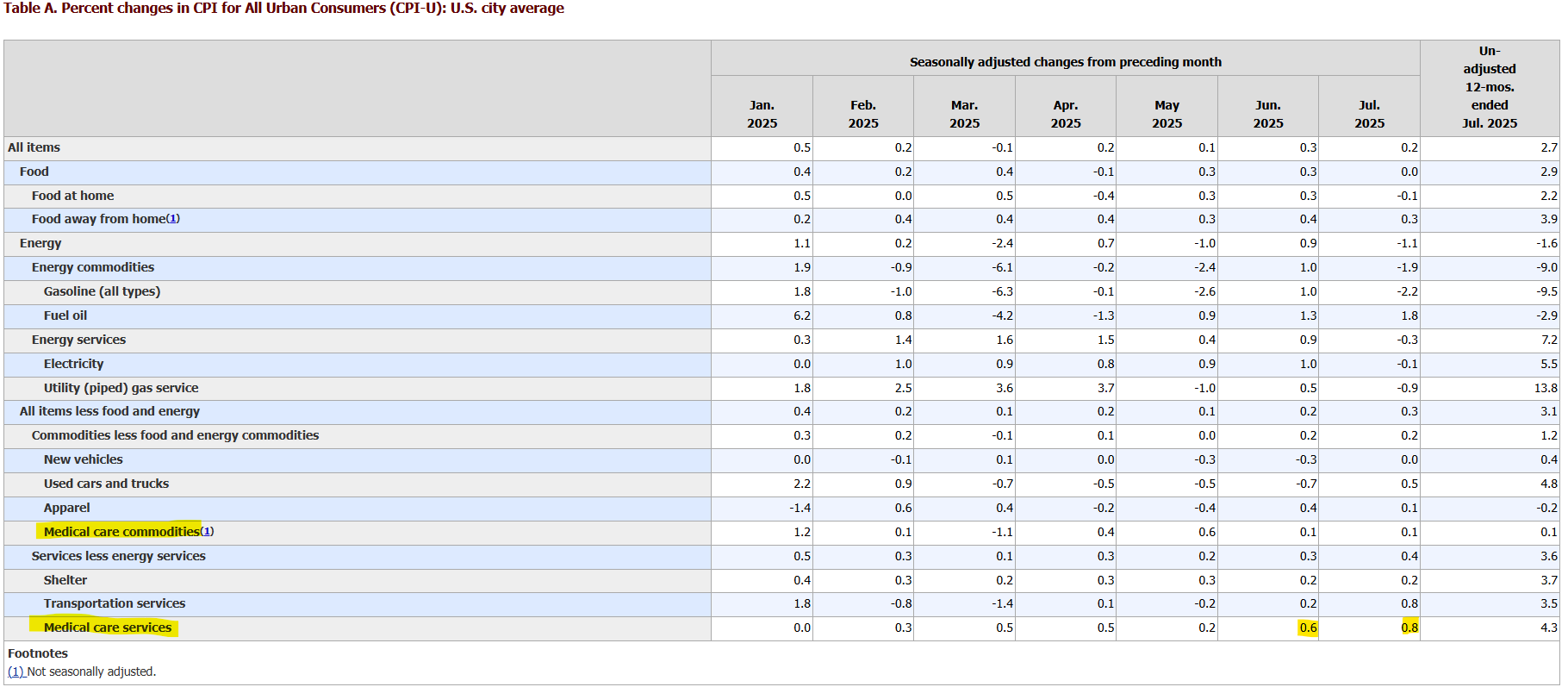

Looking deeper, services inflation remained the primary driver of the higher core reading. Medical care costs climbed, airline fares rose, and other personal services showed notable increases.

These gains offset declines in energy, where gasoline prices fell more than 2%, and a stable food category that provided some relief to consumers (you can also check on the image above). There is also a growing debate around the reliability of the data itself.

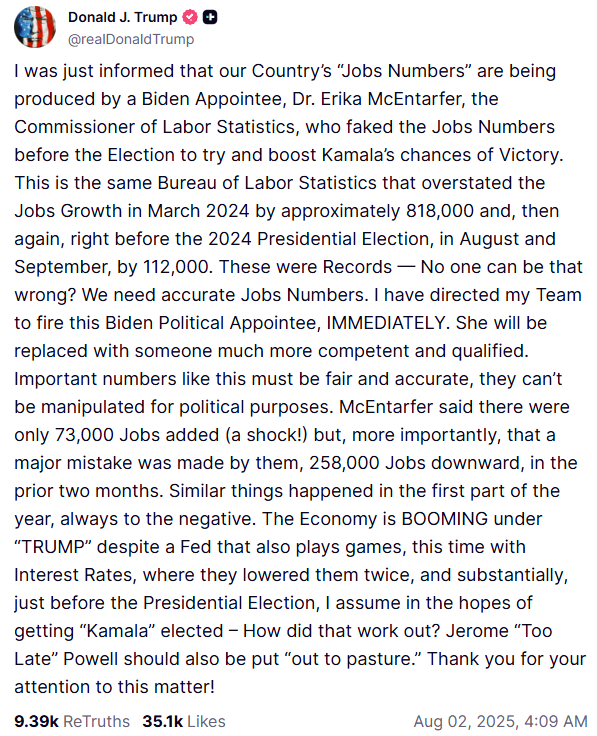

The Bureau of Labor Statistics has been relying more heavily on imputation methods due to staffing and budget constraints, and the recent dismissal of the BLS head has stirred additional questions about data integrity.

While these concerns have not derailed the headline narrative, they have added a layer of uncertainty for analysts trying to gauge the true trajectory of prices.

Markets responded positively to the numbers, focusing more on the stable headline figure than on the stubbornness of core inflation. U.S. equities rallied strongly, with the S&P 500, Nasdaq, and Dow all pushing to record highs.

The U.S. dollar slipped modestly as traders interpreted the data as supportive of a more dovish Federal Reserve stance.

The euro gained against the dollar, and U.S. Treasury yields moved slightly lower, reflecting an increase in expectations for rate cuts later this year.

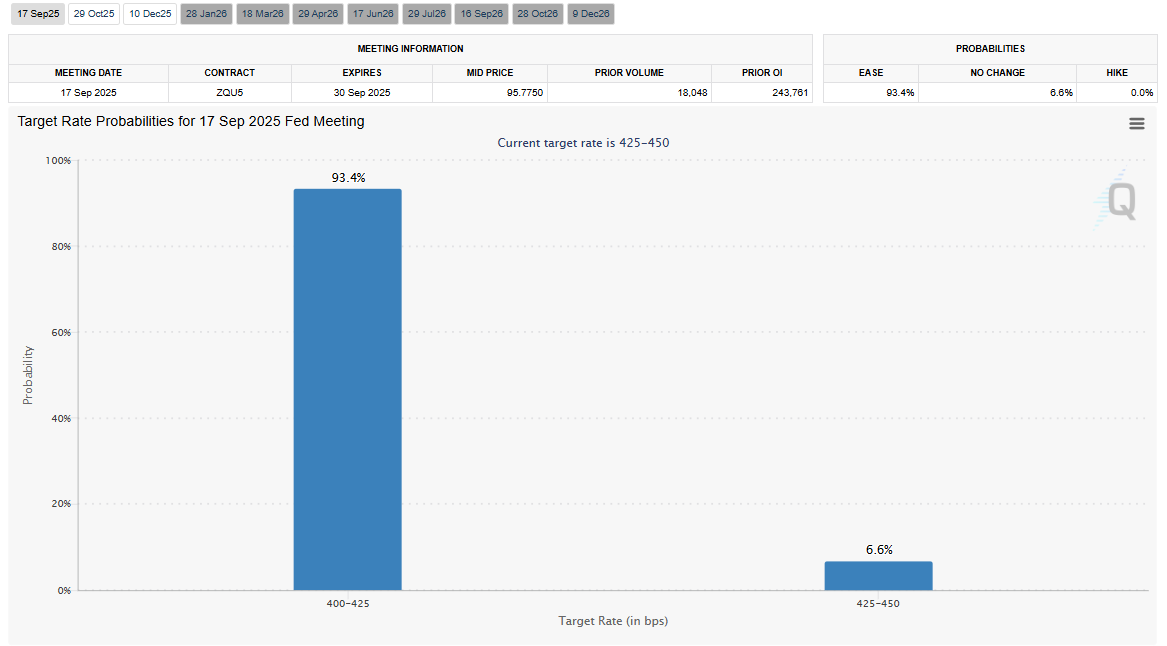

The CME FedWatch tool, which tracks market-based probabilities for Fed moves, showed a sharp jump in the likelihood of a 25-basis-point cut at the September meeting, with odds climbing above 90% in the hours after the release.

For the Federal Reserve, the latest CPI report presents a mixed picture. The lack of progress in reducing core inflation could temper enthusiasm for aggressive easing, but the unchanged headline number provides enough cover for at least one rate cut before year-end.

The Fed will be watching closely for signs that tariffs, already implemented in several sectors, begin to feed more directly into goods prices. So far, the pass-through has been limited, but that may change in the coming months.

At the same time, the strength in services inflation suggests that domestic demand remains resilient, complicating the case for a rapid shift to looser monetary policy.

From a market perspective, this CPI print reinforces a short-term narrative of policy easing and equity market strength, while keeping alive the risk that inflation could reaccelerate if service sector pressures persist or if tariffs begin to bite.

For traders, the immediate aftermath favors a softer dollar and continued momentum in risk assets, but the medium-term picture will hinge on the next few inflation and employment reports.

For now, the balance between steady headline prices and sticky core inflation means the Fed is likely to proceed with caution, cutting rates but doing so gradually to avoid reigniting inflationary pressures.

Q1: What was the main takeaway from the July U.S. CPI report?

The headline CPI stayed unchanged at 2.7% year-over-year, slightly below expectations, while core CPI rose to 3.1%, marking the largest monthly increase since January. This shows overall inflation is stable, but underlying pressures remain.

Q2: Which sectors contributed most to the increase in core inflation?

Services were the main driver, with notable rises in medical care, airline fares, and other personal services. Energy prices fell and food prices remained stable, helping to contain the headline number.

Q3: How did the markets react to the CPI release?

U.S. stocks hit record highs, the U.S. dollar softened, and Treasury yields dipped as traders interpreted the report as supportive of a more dovish Federal Reserve stance.

Q4: How does this CPI report affect the Federal Reserve’s outlook?

The steady headline figure and the market’s reaction make a September rate cut more likely, with CME FedWatch showing over a 90% probability. However, persistent core inflation means the Fed is likely to ease gradually rather than aggressively.

Q5: What should traders and investors watch for next?

The next key indicators will be upcoming inflation and employment reports, as well as the potential impact of tariffs on goods prices. These will help determine if the current easing bias from the Fed can be sustained.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.