Markets on Edge: Between Missiles, Monetary Policy, and Mispricing

ACY Securities - Luca Santos

ACY Securities - Luca Santos

Despite the dramatic escalation in the Israel-Iran conflict, FX markets are starting the week in a relatively calm posture. After Israel launched another wave of coordinated strikes deep into Iranian territory over the weekend reportedly targeting key military and nuclear sites the initial reaction across currencies was modest. The dollar saw a brief lift on Friday but failed to hold those gains into Monday. Most major FX pairs are trading sideways, with DXY hovering near year-to-date lows at 97.60. There’s a strong sense that market participants are watching and waiting reluctant to price in full geopolitical risk until it disrupts global flows more directly.

This muted FX reaction is, in part, a reflection of the current scope of the strikes. Israel appears to have avoided direct attacks on Iran’s oil fields and crude-shipment infrastructure. That has kept Brent crude below panic levels after briefly spiking to $78.50 on Friday, oil has since slipped back toward the $73 range. However, Tehran’s top IRGC officials have not ruled out the possibility of shutting down the Strait of Hormuz the artery through which over a quarter of the world’s oil flows. Should Iran take that route, it would ignite a much more aggressive risk-off move, hit risk currencies and boosting safe havens like the yen, Swiss franc, and gold.

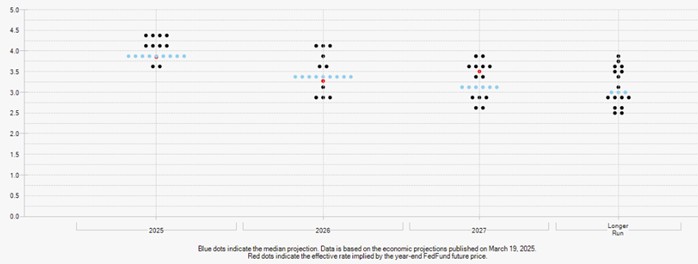

Geopolitics Meets Central Bank Caution

The geopolitical crisis comes just as we enter a heavyweight central bank week. The Bank of Japan, Federal Reserve, and Bank of England are all due to make policy decisions, and the timing couldn’t be more sensitive. For the Fed, the recent CPI release confirmed a continued cooling of inflation, but not enough to trigger an immediate rate cut. Markets still expect the Fed to stay on hold in June, with the focus now turning to the updated dot plot. The previous guidance suggested two cuts by year-end that may hold, but the risk is rising that one of those is pushed into 2026.

Dot Plot Chart FOMC

Unless the Fed strikes a more decisively dovish tone on Wednesday, the dollar may struggle to extend losses. That said, even a neutral stance may not save the greenback if geopolitical anxiety flares further. There’s also growing speculation that Trump’s “pause” on new tariffs a 90-day window that temporarily halts escalation with China could be a strategic manoeuvre heading into election season. Markets have responded favourably in the short term, especially Asian FX, but if volatility picks up again later in the year, that optimism could fade quickly.

China’s Mixed Signals Add to the Fog

From Asia, China posted mixed but broadly encouraging economic data. Retail sales jumped by 6.4% in May, outperforming expectations and marking the strongest print since April 2023. The surge was largely driven by targeted fiscal support, including trade-in subsidies for home appliances a policy moves clearly aimed at stimulating household demand. However, other indicators were less rosy. Industrial production and fixed asset investment both slowed modestly, pointing to uneven momentum across sectors.

China’s external picture remains fragile. Despite upbeat domestic consumption, exports to the U.S. dropped sharply last month down over 30% year-on-year reflecting the deeper structural hit from the ongoing trade war. President Trump’s decision to delay further tariffs until at least September has bought China some time, but the uncertainty hasn’t gone away. Whether this growth spurt can sustain itself into the second half of the year remains to be seen. The yuan has rebounded slightly alongside Asian peers, but positioning remains cautious as many traders suspect this is a temporary reprieve.

Yen in Focus as BoJ Weighs Next Steps

The Bank of Japan is under pressure this week to address rising uncertainty both at home and abroad. While rates are expected to stay unchanged, attention is squarely on QT plans. Media reports ahead of the meeting suggest the BoJ may opt to slow its bond purchase tapering schedule beginning April 2026. This would be a dovish pivot, reflecting caution amid soft domestic growth and potential spillovers from global conflicts. The recent strength in longer-dated Japanese government bonds hints that traders are already pricing in a less aggressive QT path.

USDJPY H1 Chart

Despite yen weakness in recent weeks, USD/JPY remains sensitive to even subtle shifts in BoJ communication. If Governor Ueda signals a slower unwind of monetary stimulus while maintaining vigilance on inflation, the yen could find support. And in the event of further Middle East shocks especially involving oil or energy security the JPY could quickly regain its status as the top safe haven of the G10.

The FX market is showing an odd kind of complacency given the risks on the table. Traders are holding fire ahead of this week’s central bank decisions and waiting to see whether the Israel-Iran conflict crosses red lines that would genuinely disrupt energy flows. For now, there’s been no oil embargo, no Hormuz closure, and no global escalation just yet. But the narrative can change fast, and when it does, positioning will matter.

If tensions escalate, gold (XAU) could test new highs, oil-sensitive currencies like CAD and NOK may surge, and safe havens will catch a strong bid. Conversely, if diplomacy manages to de-escalate the current standoff, the market may shift focus back to macro fundamentals rate paths, inflation trajectories, and growth momentum.

We’re standing at a pivotal intersection between geopolitics and monetary policy. Don’t expect the market to stay quiet for long. Stay nimble, stay informed and if you’re trading FX this week, watch central bank language as closely as the missile headlines.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.