.jpg&w=3840&q=75)

SPX Eyes Resistance as ISM Prices Ease

Alchemy Markets - Zorrays Junaid

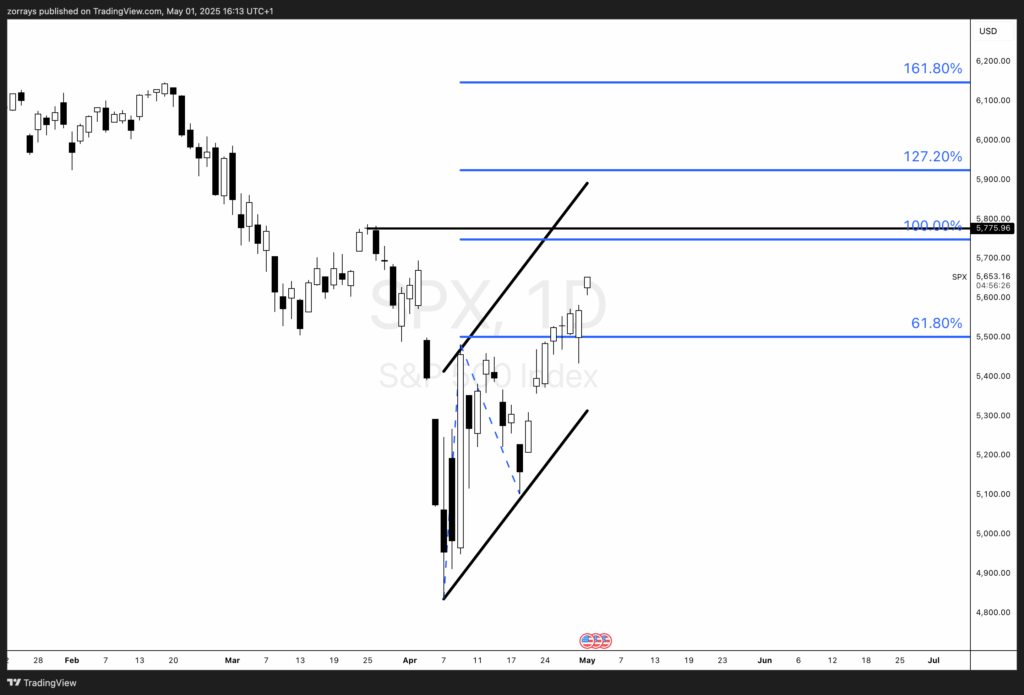

Alchemy Markets - Zorrays JunaidThe S&P 500 ($SPX) opened with a bullish gap today and continued grinding higher within a rising wedge structure. The move came alongside a cooler-than-expected ISM Manufacturing Prices reading, which printed at 69.8 vs. 72.9 forecast. While still elevated, the data suggests that input cost inflation may be losing steam—fueling hopes that broader disinflation trends remain intact.

This softer pricing signal gave the market a reason to breathe, especially with the Fed meeting in focus and rate cut timing under debate.

Technicals at play:

- The SPX remains inside a rising wedge, typically a cautionary pattern, but still suggests momentum until proven otherwise.

- Key zones to watch:

- Rising channel resistance near 5650–5700

- Horizontal resistance at 5775, a prior breakdown level

Fundamental backdrop

- Cooling ISM Prices: Despite remaining high, today's pullback from expectations softens the inflation narrative for now.

- Rate sensitivity: Traders are watching for any Fed dovish tilt amid softening price data, even if services inflation remains sticky.

- Earnings support: Tech continues to carry the index, but sector rotation remains thin—implying fragility if mega-cap momentum fades.

What to watch

- A continued grind toward 5775 may keep bulls engaged, but any rejection at wedge resistance could trigger a sharp reversal.

- Friday's NFP and wage data will be critical in validating whether this ISM print is a one-off or the start of broader cost relief.

For now, the market is leaning optimistic—but with defined technical levels and macro landmines ahead, this is a time for precision, not complacency.

Disclaimer: Trading leveraged products carries a high level of risk and may result in losses exceeding your initial investment; ensure you fully understand the risks involved.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.