USD/JPY Forecast: CPI Split, 94.2% Fed Cut Odds Keep Price Range-Bound

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita- USD/JPY stalls below 148.50 as mixed U.S. CPI results keep price capped at the H4 Fair Value Gap.

- Fed rate cut bets at 94.2% maintain short-term support, but upside is limited without a decisive breakout.

- Technical bias split - breakout above 148.50 eyes 149.50, while rejection risks a slide toward 146.60.

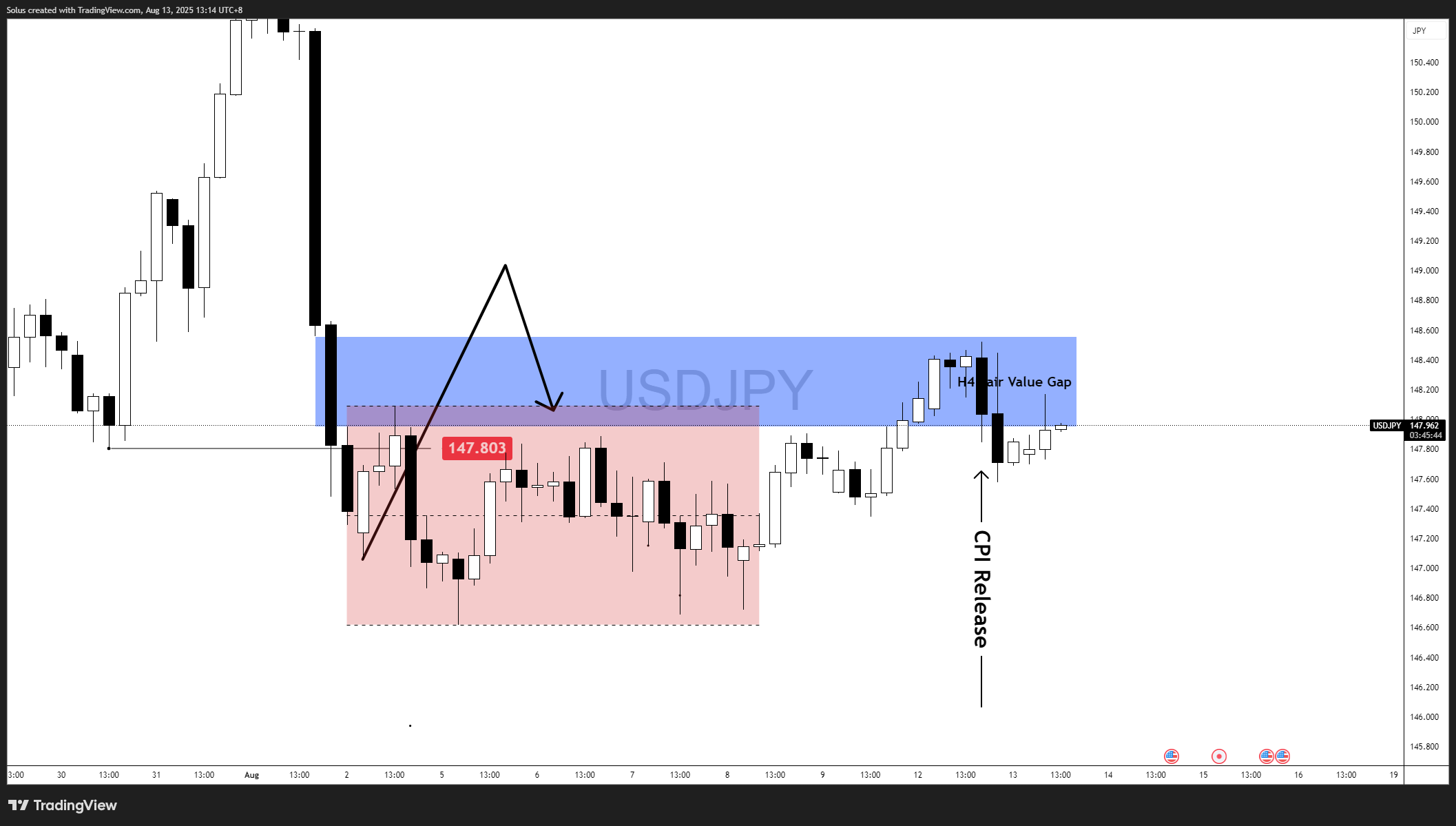

Previous Forecast Recap (Webinar)

In our last webinar, we highlighted 148.00–148.50 as the key rejection zone unless U.S. CPI delivered a strong dovish surprise. We noted that a failure at this level could open the path toward 146.50, targeting previous demand.

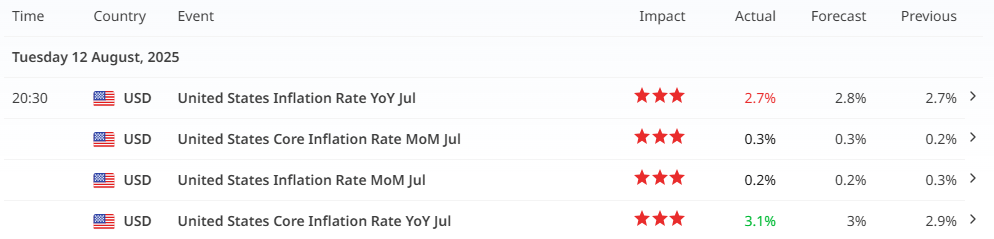

CPI Results: Mixed Message

On August 12, CPI data brought a split outcome:

- Headline CPI YoY: 2.7% (vs 2.8% forecast) → Dovish.

- Core CPI YoY: 3.1% (vs 3.0% forecast) → Hawkish.

The soft headline reinforced easing expectations, but the hotter core print kept the Fed from being fully locked into aggressive cuts, creating two-way volatility in USD/JPY.

Post-Release Price Action

The pair rejected the 148.50 ceiling, confirming our pre-CPI bias. Price is now consolidating in the 148.50–147.50 range, awaiting a breakout trigger from further U.S. data or Fed commentary.

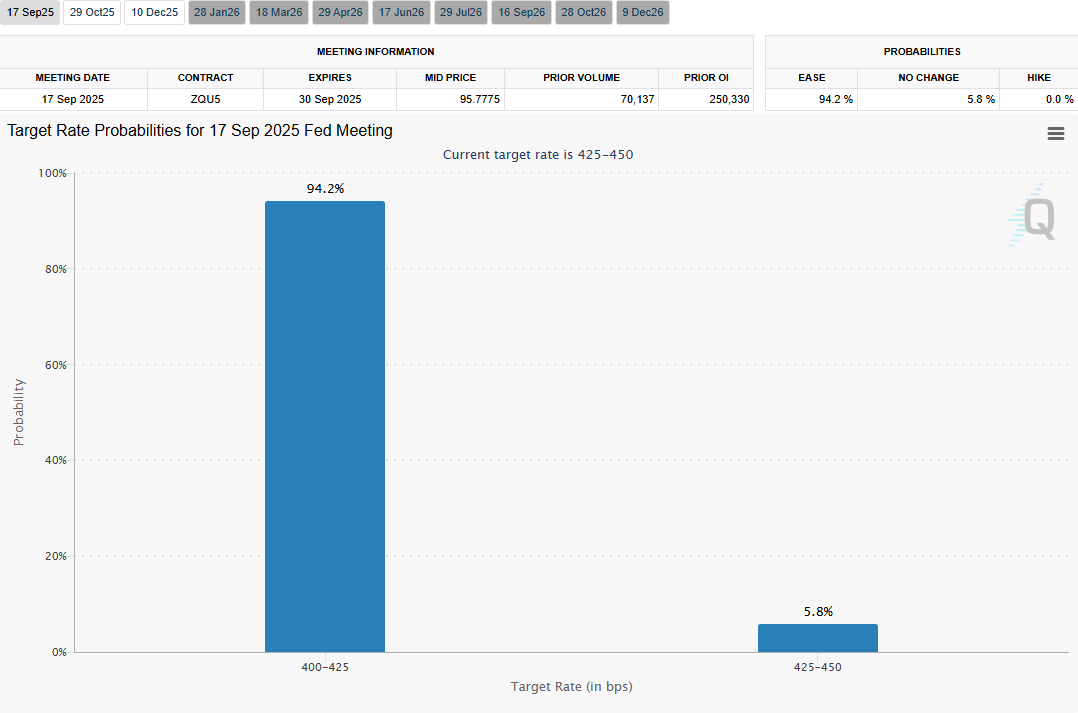

Rate Cut Probability – September FOMC

According to the CME FedWatch Tool following the CPI release:

- 94.2% probability of a 25 bps rate cut (target range 4.00–4.25%).

- 5.8% probability of no change.

- 0% probability of a hike.

This strong consensus for easing keeps USD/JPY supported in the short term, but with the risk of dollar weakness if future data aligns with the softer headline CPI trend.

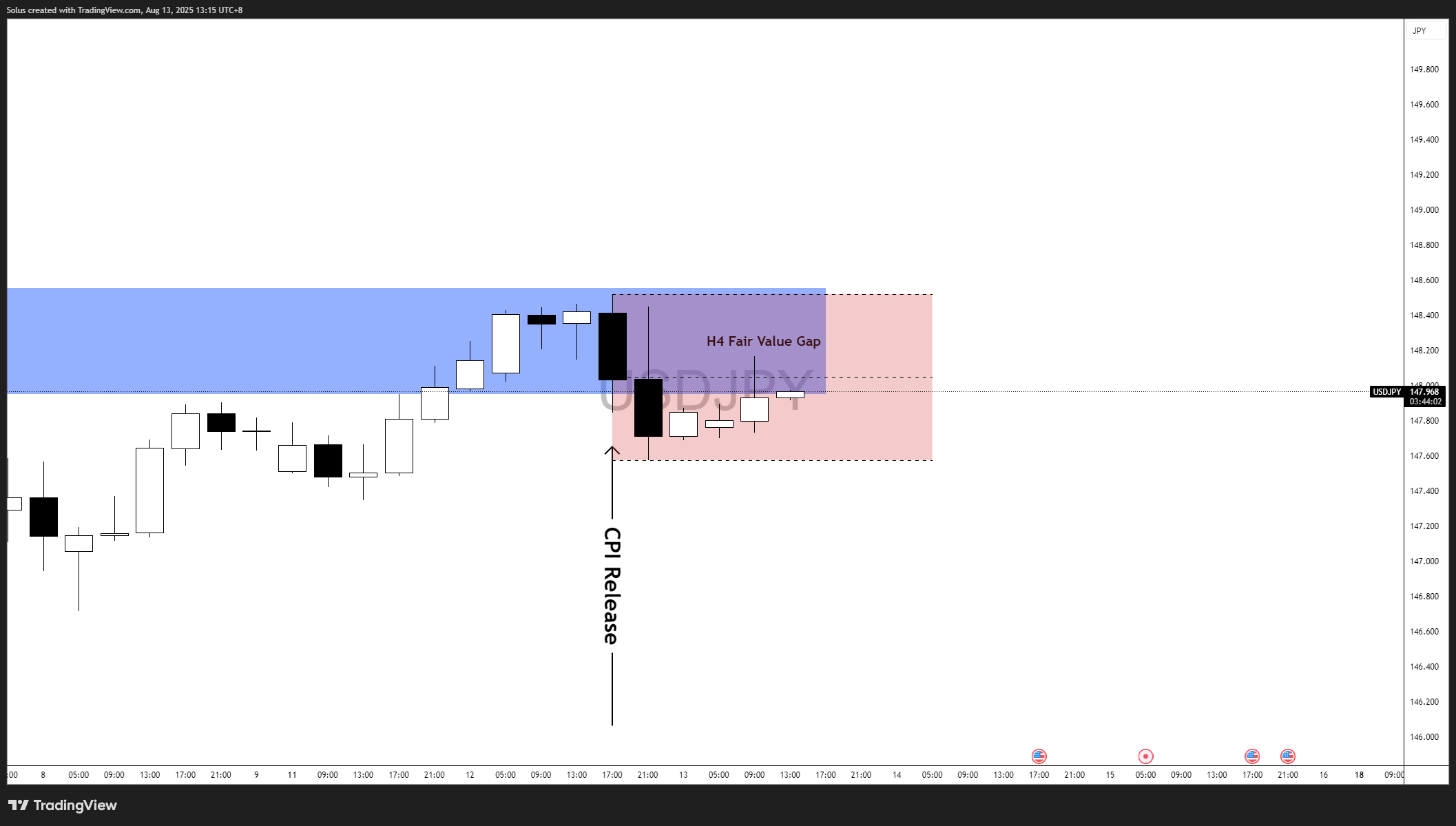

Technical Outlook – USD/JPY Post-CPI Structure

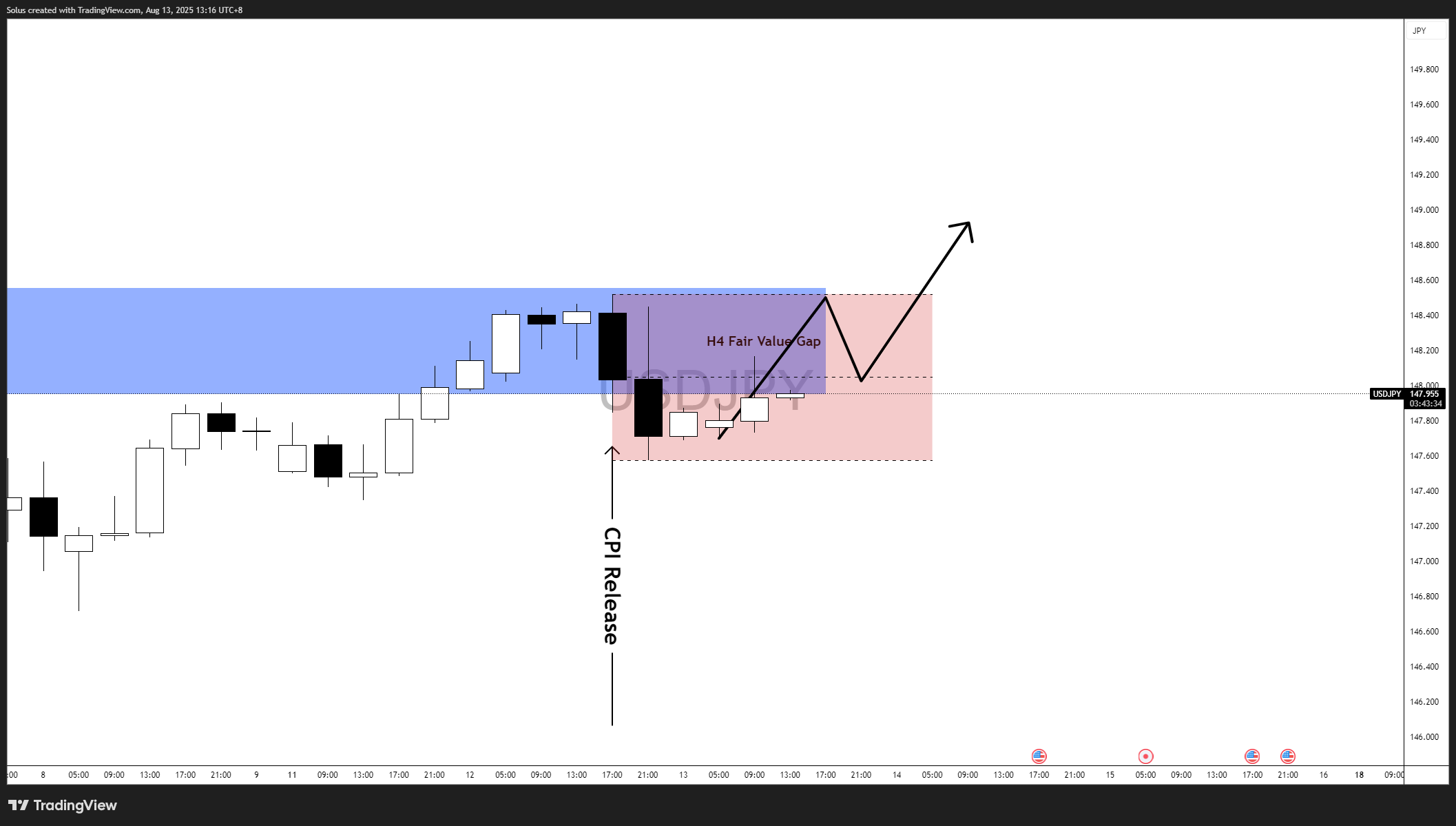

Following the CPI release, USD/JPY reacted with a sharp rejection from the H4 Fair Value Gap, aligning with the supply zone we outlined in the pre-event forecast.

- Pre-CPI Build-Up: The pair climbed steadily into the bearish fair value gap, showing controlled bullish momentum ahead of the release.

- Immediate Reaction: CPI data triggered a swift bearish impulse, driving price back lower from the H4 Fair Value Gap. This confirmed and aligned with the dovish or soft print of the CPI release, signaling, weakness on the dollar.

- Post-CPI Consolidation: Price is now ranging just below the FVG ceiling, holding around 148.00–148.50, signaling indecision as the market weighs mixed inflation signals against high Fed cut expectations.

Bullish Scenario – Range + FVG Breakout

Following the CPI release, USD/JPY has been consolidating within the H4 Fair Value Gap after an initial downside reaction. The current structure suggests the potential for buyers to reassert control if price action follows through on a clean breakout.

Key Bullish Triggers:

- H4 FVG Reclaim – A decisive 4H close above 148.20 would confirm that buyers have gained traction, signaling renewed bullish intent.

- Pullback Retest Hold – After breaking above the FVG, a retest of 148.00-148.20 holding as new support would strengthen upside momentum.

- Continuation Pattern – Sustained higher lows following the retest would pave the way for a measured move higher.

Targets:

- 1st Target: 148.80–149.00 – Psychological and short-term liquidity zone.

- 2nd Target: 149.50 – Next liquidity pool before 150.00 round number.

Invalidation:

- A rejection back below 148.50 and a close under 147.50 would weaken the bullish setup and put the bearish scenario back in play.

This bullish pathway aligns with the macro backdrop of a 94.2% Fed rate cut probability, which generally supports carry trade flows into USD/JPY. If risk sentiment remains steady and Japanese yields stay suppressed, buyers could leverage the current consolidation as a launchpad for a push toward the 149 handle.

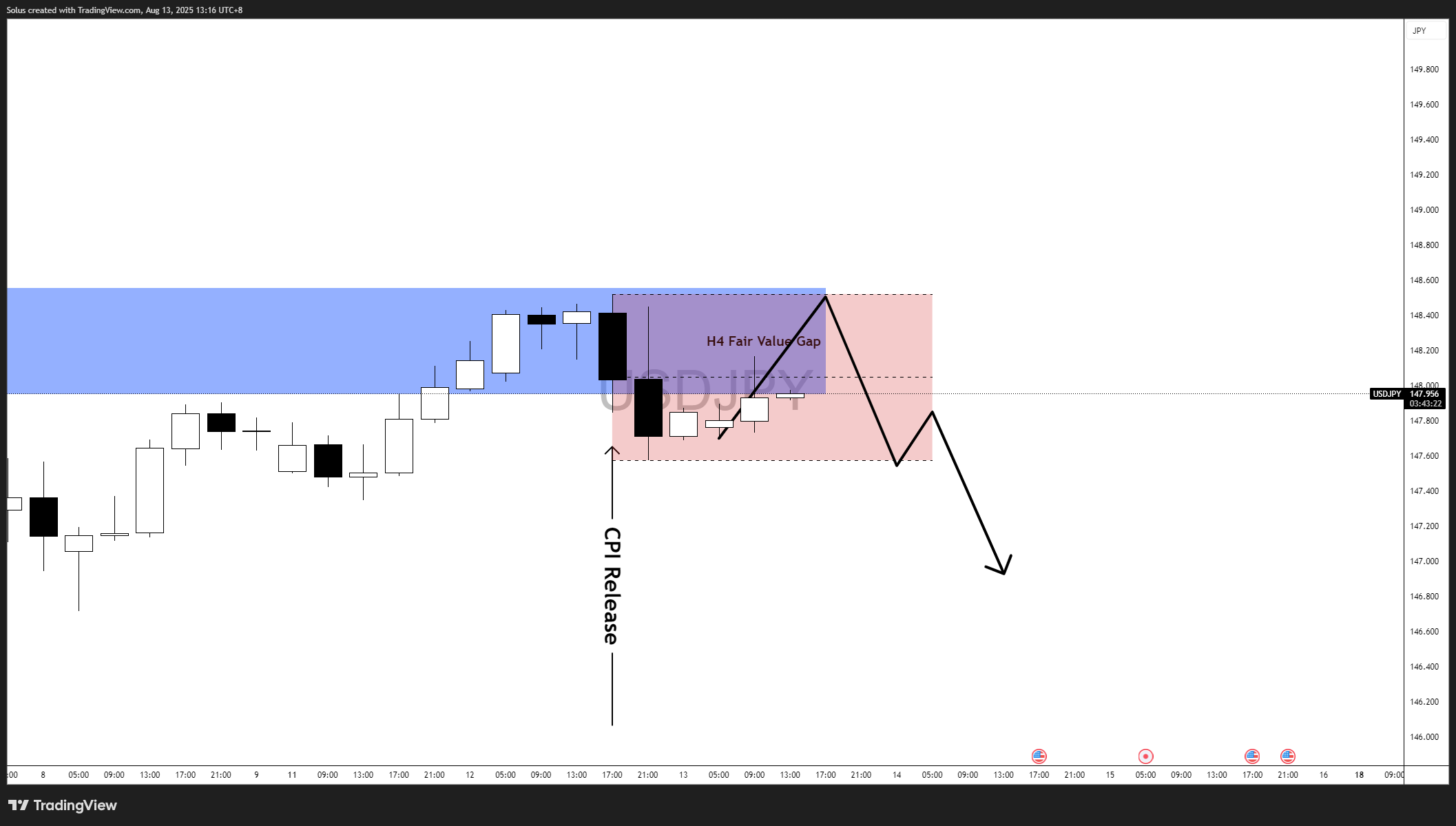

Bearish Scenario – FVG Resistance Holds

Price remains capped within the H4 Fair Value Gap, showing signs of weakness. Sellers could regain control if price action respects this zone as a ceiling.

Key Bearish Triggers:

- Rejection at FVG – A failure to break and hold above 148.50, with strong rejection wicks or bearish engulfing candles, signals low traction in favor of the dollar.

- Break Below 147.50 – Losing this intraday support would confirm bearish momentum and invite further downside pressure.

- Continuation After Pullback – A retest of the bottom FVG (148.00) turning into resistance would reinforce short setups.

Targets:

- 1st Target: 147.00 – Psych Level

- 2nd Target: 146.60 – Deeper liquidity pool from previous accumulation.

Invalidation:

- A clean 4H close above 148.20-148.50 would nullify this bearish bias and open the door for bullish continuation toward 149.00.

The rejection from the H4 Fair Value Gap aligns with the idea of distribution at premium pricing, particularly as the market digests mixed CPI signals. While a 94.2% Fed cut probability leans dovish for the USD in theory, if the yen strengthens on any BoJ commentary or risk-off sentiment, sellers could drive the pair into a deeper retracement phase.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2025

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.